New York State Standard Deduction 2024 – The House Rules Committee approved a bill led by New York Republicans on Thursday that would increase the state and local tax (SALT) deductions cap, setting up a potential floor vote on the . “In general, New York’s state income tax system can be considered To reduce their taxable income, New Yorkers can claim either a standard deduction or itemize their deductions, such as medical .

New York State Standard Deduction 2024

Source : www.empirecenter.orgMore than 700K Michigan households getting tax credit checks in 2024

Source : www.clickondetroit.comComments on New York City’s Executive Budget for Fiscal Year 2024

Source : comptroller.nyc.govNew York State Income Tax Rates for 2024 (Tax Year 2023)

Source : www.businessinsider.comIRS releases 2024 tax brackets; What is new standard deduction

Source : www.al.com2023 State Income Tax Rates and Brackets | Tax Foundation

Source : taxfoundation.orgNew York Paid Family Leave Updates for 2024 | Paid Family Leave

Source : paidfamilyleave.ny.govNew York Labor Law Posters State and Federal Combo (2024)

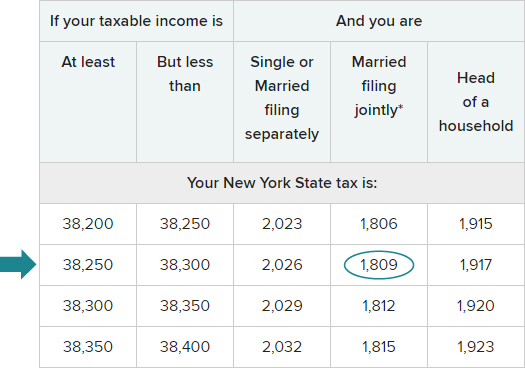

Source : www.laborlawcc.comTax tables for Form IT 201

Source : www.tax.ny.gov2% Property Tax increase in Elmira 2024 Budget Proposal

Source : www.mytwintiers.comNew York State Standard Deduction 2024 How the tax cut stacks up Empire Center for Public Policy: That question is at the heart of a new proposal the cap on the state and local tax (SALT) deduction—but just for one year. When you file your tax return, you have the option of itemizing your . What better way than by capping the deductibility of state and called the SALT deduction “the single most important issue” to his constituents. He said other New York Republican members .

]]>